PPVC Approach

The PPVC approach draws on a package of empirically-grounded tools designed to answer key questions at different stages of the policy and investment process. These tools include four main components, namely Value chain mapping and gross margin analysis, Geo-spatial contextualization, Multi-market partial equilibrium (PE) modelling (BFAP multi-market model), and CGE economy wide modelling (IFPRI RIAPA model). The specific tools are detailed below.

Phased Approach to PPVC :

Phase 1: Value Chain Ranking & Selection

In-country stakeholder engagement for alignment and policy demand. This includes work to understand governments’ currently articulated value chain priorities (which may be articulated in NAIPs or flagship programs etc...) and other political priorities.

The selection process involves considerations such as the strategic importance and growth opportunities of value chains that align closely with government policy ambitions. The motivation for only selecting a few value chains for PPVC rankings stems from a few considerations. First, a particular value chain needs to be established for it to be able to make a significant impact on agricultural transformation. This implies that niche and upcoming value chains are excluded on the grounds that any policy interventions would only make marginal economy-wide impacts on critical development outcomes such as economic growth, employment and poverty reduction at the national level. Furthermore, to develop indicators for each value chain a threshold set of data needs to be available for the models and analytics used in the rankings.

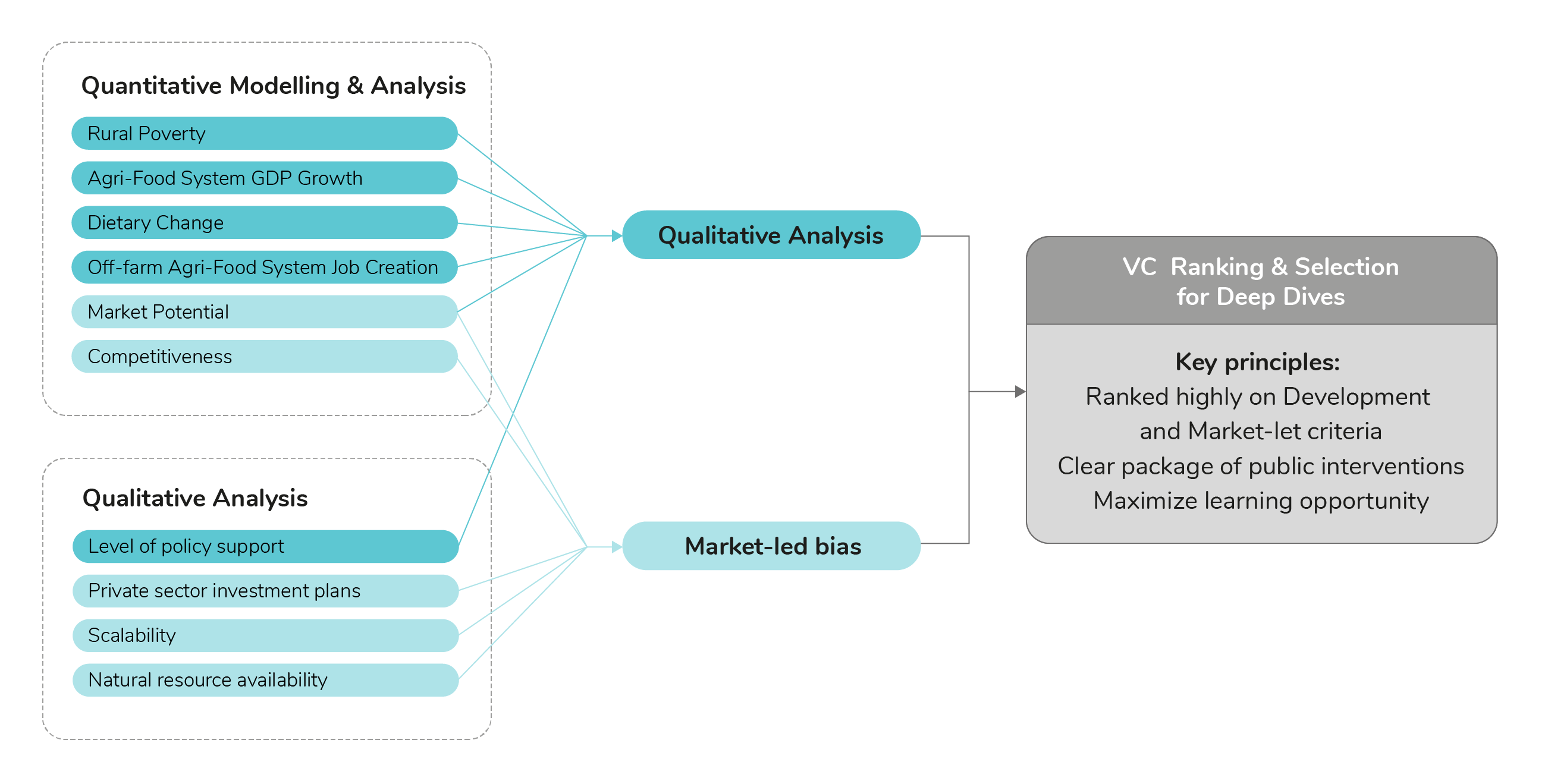

Value Chain Rankings

- Set-up of quantitative selection criteria matrix.

Output from VC, PE and RIAPA models are merged into the IAT matrix for the ranking of value chains.

- Market-led indicators: Potential for intensification, Domestic consumption growth, Regional Export Potential, Relative Trade Advantage (RTA), Input cost to use ratio

- Inclusiveness indicators: Poverty Reduction, Agri-food System Employment

- Transformation indicators: Agri-food system growth, Diet Quality

- Climate indicators: Yield volatility, Water footprint and GHG emissions

- Data collection, availability & integrity.

Based on a list of prioritized value chains, data is collected to populate market-led, inclusiveness, transformation, climate and social inclusion indicators for ranking of value chains. This activity also includes the collection of time series data to develop commodity balance sheets, parity and local prices for each prioritized value chain

- PE baseline market outlook.

Develop PE models for prioritized value chains. This involves estimating equations in a multi-market modelling approach for all supply and demand variables in the commodity balance sheets and prices. The output from the PE baseline market model is a 10-year outlook that features the long-term projected trends for each of the supply, demand and price variables under baseline assumptions on population growth, economy, exchange rate, climate etc.

- RIAPA Economy-wide national baseline.

As part of the value chain selection phase, RIAPA is used to simulate the effects of expanding farm production within existing agricultural value-chains. Total factor productivity (TFP) growth in the farm component of each value-chain is accelerated beyond baseline growth rates, such that, in each value-chain scenario, total agricultural GDP is one percent higher in the future than it is in the business-as-usual baseline scenario. Expanding farm production increases the supply of raw agricultural products, which impacts household incomes, stimulates production in downstream processing activities, and generates demand for trade and transport services. RIAPA measures the impacts of these direct and indirect effects on various social inclusion and agricultural transformation outcome indicators. These can aid policymakers’ understanding of the contribution of value chains to broader agrifood system growth and employment, as well as their effects on poverty and diet quality. These RIAPA outcome indicators are used alongside other PPVC outcome indicators (e.g., from the qualitative value chain scans or partial equilibrium modeling) to rank and ultimately select shortlisted value chains for deep dive analysis.

- PE-RIAPA handshake (coding and assumptions).

Alignment on a range of macro (GDP growth, exchange rate, population etc) and technical coefficients is required between the PE and the RIAPA model to ensure simulation of baseline and alternative future states are consistent.

- Value chain scans & ground truthing.

This includes assessments of current levels of policy support and complementary public [and private] investments; ‘scalability’ of value chain to other value chains (e.g. upgrading the soybean value chain benefits livestock feed value chains) and agro-ecological potential of each value chain.

- Shortlisting from ranked existing value chains.

The indicators from the various models are combined using a Garrett Ranking technique. The indicators inform a ranking outcome for each category. These can be regarded as orders of merit assigned to value chains through the indicators. The final ranking of value chains is assigned according to mean scores: highest mean score ranking first and lowest mean score ranking last.

- Engagement with targeted stakeholder working groups.

Present quantitative and qualitative results on prioritised value chains to wide group of stakeholders (public and private sector) who have participated from the start of the process.

- Final value chain selection.

Value chain selection is informed by the ranking but occurs in collaboration with stakeholders and policy makers in country. In the various countries where the approach has been rolled out to date, the ranking was a key consideration in choosing relevant value chains, but the choice was also informed by urgency and need for actions from policy makers. Consequently, while higher ranking value chains have been chosen, it has not simply come down to choosing the highest-ranking value chains for deep dive analysis.

Phase 2: Value Chain Deep Dives – Prioritising Policy Reforms and Investments

The PPVC deep dives of selected value chains involve a detailed assessment of end-to-end product flows, gross margin estimates, the economic feasibility of establishing improved or upgraded value chains, and the policy and investments required to do so. Deep-dive value chain analysis and economy-wide impacts involves the following activities:

- Value Chain Overview

Develop an overview of the global, regional, country, industry and value chain context.

- Value chain structure - key actors and product mapping.

Identify critical stakeholders, parts of the value chain they engage in and their relationships throughout the value

chain, and establish associated market shares, operational costs, capacities and constraints. This includes a

summary of major challenges and constraints faced by the various value chain actors.

Develop end-to-end product flow map that provides clear route to market from farm-gate, through to trading,

processing, and market segments. This product flow map has to align with supply and demand estimates in the PE Model

to ensure alignment of simulations once value chain upgrades are introduced.

- Evaluate economic feasibility - gross margins/profitability.

Estimate gross margins and economic feasibility under “business as usual” conditions for each node of the value chain. This includes costing of raw materials, relative parity pricing and price ladder with cost build-up throughout the chain.

- Spatial analysis - location of production/consumption/processing hubs & public investments.

Spatial contextualization and integration of value chain attributes, including e.g. location of production potential versus actual production, consumption hotspots, infrastructure, ports, etc.

- Identify potential reforms/upgrades: policies & investments.

Define an “ideal or improved state” for the value chain, in which key bottlenecks and constraints are addressed using specific levers of change, including but not limited to value chain investments (public and private) and policy levers. In order to reach the ideal state, a combination of investments and policies are formulated at specific nodes of the value chain aimed at unlocking more value out of the market system and to boost the level of participation/inclusiveness. It is important to assess the gender implications (ex-ante) of a VC upgrade (differential impacts on men and women VC actors). Identifying the potential state of the value chain is made possible by engaging industry specialists and private sector actors with local and international knowledge and expertise.

- Modelling alternative future states (PE and RIAPA recursive dynamic with handshake between VC, PE, RIAPA tools).

This phase presents the most challenging component of the PPVC approach from a modelling and analytical phase

because value chain models, PE models and RIAPA are all linked in a recursive approach to develop alternative future

states for a value chain.

The alternative future state is based on the prioritized policy reforms and investments that are introduced in the VC, PE and RIAPA models.

- Partial equilibrium (PE) model determines how much demand there will be for the new product and what price it will sell for in domestic or foreign markets

- Gross margin analysis determines production costs at each stage of the supply chain, incl. labor costs, and what profits actors in the supply chain will earn

- Economy wide model determines national economic growth, incl. incomes and domestic demand, and how this effects macro indicators like exchange rates

From the RIAPA model perspective, the simulation analysis entails constructing very small, hypothetical value chains and “inserting” them into the model. The cost structures and margins, value-addition activities, and market penetration of these hypothetical value chains are based on information from the deep dives. Once the new value chains are established, they are brought to scale and start competing with existing value chains. The costs associated with policies and investments required to bring the upgraded value chains to scale are also internalized in the model. The modeling analysis provides results on the economywide returns to policies and value chain investments, for example, in terms of growth, employment, or poverty.

- Clear articulation of policy and public investment recommendations.

Present a clear set of prioritized reforms that present a clear case how the value chain could be restructured and optimized to enhance competitiveness, profitability and transformational outcomes. The reforms also provide detail on timing and possible implementation structures

- Assessing value chain-specific climate resilience and impacts

During the ranking of value chains, climate indicators are focusing on yield volatility, water footprint and GHG emissions. The value chain-specific ‘deep dive’ analysis, will include:

- Identification of market-led, value-chain specific interventions delivered by the public and/or private sectors and which are contributing to the NDCs and NAPs.

- Opportunities to reform and improve implementation R&D and extension services to help improve the profitability, efficiency, and competitiveness of each value chain, based on PE modelling (data permitting).

- An initial articulation of how ‘upgraded’ (modeled) value chains will help to improve climate resilience and/or reduce emissions.

Post-selection and implementation support to governments to help them track and assess the implementation of adopted (PPVC-informed) reforms involves the following activities:

- Presentation to key stakeholders

A structured and focused approach is required for continuous engagement with a wider platform of key stakeholders.

- In-country continuous engagement with public and private sector

Whereas the traditional approach to the dissemination and communication of evidenced based policy analysis, particularly by more academically oriented research initiatives, has focused mainly on national and provincial government platforms, the active engagement by the PPVC team with private sector investors as well as industry forums has proven to be invaluable not only during the analytical phase, but also during post-reform implementation support to keep track of the impact of reforms on real-world market dynamics, investments and critical insight in the development of further proposed interventions.

- Facilitation and analyses of follow-up policy questions

In countries where PPVC has been implemented, local think-tanks have engaged with in-country stakeholders in public and private sector to facilitate the process of further analyses of follow-up policy and investment questions and BFAP and IFPRI have been providing technical backstop on advanced analytical requirements. In some instances this engagement process has evolved into further training sessions of public and private sector in the PPVC approach.

A further activity that is related to post-implementation support includes the effective tracking and assessment of reforms that have been implemented based on PPVC deep-dive results and the consequent impact of these reforms on value chains. This involves an end-to-end value chain approach that tracks and assesses market-led indicators like product flow, profitability, competitiveness, investments and also development indicators depending on the availability of data.